VT Astute Funds

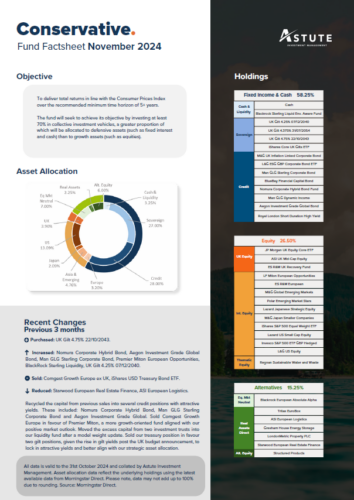

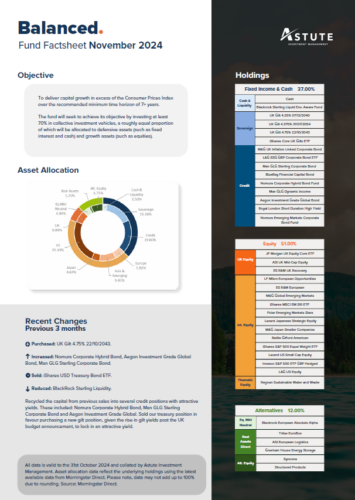

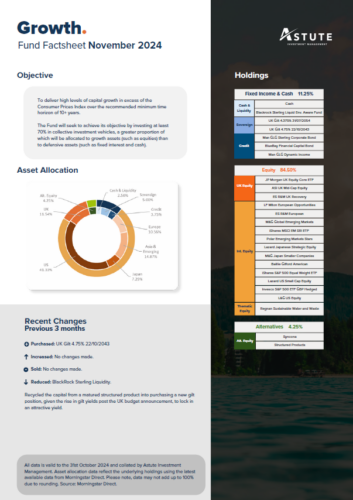

The VT Astute fund range is the flagship offering from Astute Investment Management. These risk rated, daily dealing funds were designed from the bottom up to match our client risk profiles and to integrate into the Astute advice process.

We have appointed Valu-Trac Investment Management Ltd (VT) to establish the three investment funds – the VT Astute Conservative, Balanced and Growth funds. Astute Investment Management Ltd is the investment adviser to the VT Astute funds, and is authorised to actively manage the underlying investments within each of the funds on behalf of Astute Private Wealth clients. The fund objectives are aligned to our 5 risk approaches and have been created for the exclusive use of our clients. As such, this company has the same ownership structure as Astute Private Wealth Ltd, is separately authorised by the FCA, and will form the investment management arm of Astute Private Wealth.

Factsheets

Factsheets for the VT Astute fund range can be found below:

Quarterly Commentary

The quarterly commentary for the VT Astute fund range can be found below:

Diversification

A fund of funds approach is one of the best ways to diversify your investments across different styles, asset classes and geographies, all within one convenient wrapper and without the complications of a model portfolio service. The documents below demonstrate the level of diversification within each of the VT Astute funds.

For Your Journey

-

Financial Planning

Helping you identify, achieve and maintain the lifestyle you desire.

Learn MoreHelping you identify, achieve and mai...

Financial Planning

-

Investment Planning

Helping you make the most of your wealth.

Learn MoreHelping you make the most of your wea...

Investment Planning

-

Inheritance Tax Planning

Helping you preserve & protect your wealth for future generations.

Learn MoreHelping you preserve & protect your w...

Inheritance Tax Planning

-

Retirement Planning

Helping you retire from work, not from life.

Learn MoreHelping you retire from work, not fro...

Retirement Planning

-

Mortgages

Specialist advice, tailored to your individual needs.

Learn MoreSpecialist advice, tailored to your i...

Mortgages

-

Protection Planning

Because life often gets in the way of even the best plans.

Learn MoreBecause life often gets in the way of...

Protection Planning

-

Selling an IFA Business

Make a well-informed decision about selling your IFA business.

Learn MoreMake a well-informed decision about s...

Selling an IFA Business